The Realities of Investing: Insights from a Roller-Coaster Ride with $HOCN

Read all issues on my website

Read time: 4+ minutes

Key Takeaways

- There is more learning from loss and irrational investing, than there is from outright profit.

- Learning how you feel and think during emotional roller-coasters, and reflecting on it, will make you a better investor.

- Have a plan for when things don't go your way.

Today’s issue is not about an actionable investing concept or framework. But about a real-life example of what (bad/difficult/risky) investing might look and feel like.

And it’s an attempt to break the ice to show that however stupid or irrational your decisions, you might learn something from each of them – and to help others, you need to share it.

If you want to have a chat, e-mail me at alex@stoicvalue.com. Happy to exchange battle stories.

Now, let’s dive into this one:

The most difficult thing in investing?

Dealing with errors of omission.

Dealing with regret.

Dealing with bias.

I agree with Buffett, that the rearview mirror is always clearer than the wind shield.

The technical term for this is “hindsight bias”.

Still, you know that you are human, when you feel regret about the chances not taken...

Especially when they are right in front of you.

I could moan the fact that I didn’t make a lot of money the last days.

I could blame my day job, my side-projects or the weather for what happened.

I could.

But I’m not going to.

I know that it is myself standing in my own way.

We all must feel this way sometimes. When we reach a point where we cannot proceed, feel that there is a glass ceiling holding us back from succeeding.

The only way to break through it is to shatter it into a thousand pieces by taking a moment, step back, calm down.

To reflect on our actions not taken, and the ones we took as well.

To seek counsel from someone who can relate. Who might, in fact, have been at a similar point and solved the puzzle.

We might need to do more work, more risking being wrong. To push ourselves into what we fear. Push ourselves into the “uncomfort zone”.

So what happened?

From CHF 16 to CHF 1.25 and back

I love to look at companies that have fallen from the stars, that suffer a temporary set back or are in a turnaround. Good companies that go through a rough patch. Have lost their way, went off the road. But still have the capabilities to reorient themselves and get back on track.

Why?

Because you can learn so much from those situations and if you are lucky – yes lucky – you might hit it out of the park.

So, I snatched up a few shares of $HOCN a Swiss milk processing company.

It's the 3rd largest in Switzerland.

The last few years were littered with bad decisions by the previous management. Shareholders standing by.

They acquired a customer of theirs – this is called forward integration in business strategy lingo.

They – the holding company to be exact - financed the transaction by issuing a CHF 125m hybrid-bond with an infinite term at 2.5% in 2017. If they would not pay it back 21 June 2023 the interest would rise for another 2.5% plus a premium based on a swap rate.

Additionally, the company may opt to defer the interest payments indefinitely.

As a matter of fact, Hochdorf did opt to not pay back the bond in 2023 and postponed the interest payments.

That’s now a hefty CHF 6.25m interest payment that has to be paid – each year.

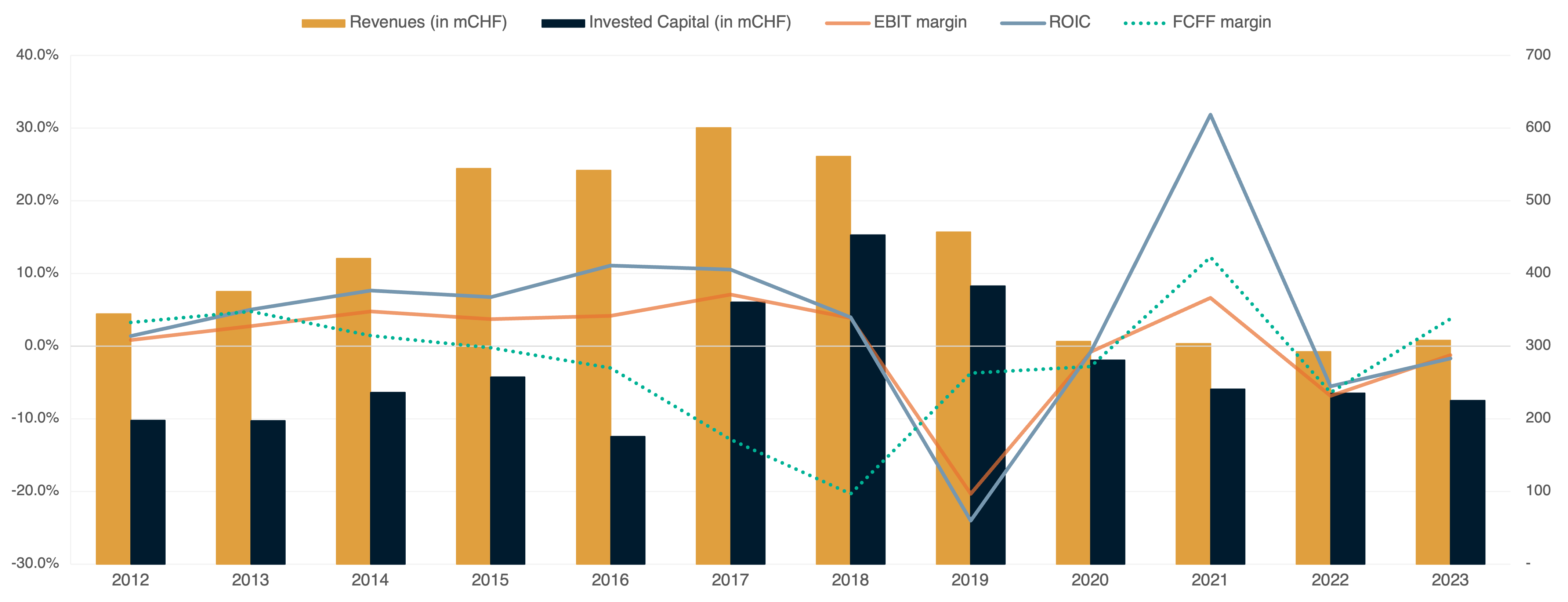

Given that they incurred a loss at the EBIT level of CHF 4m in 2023 – although materially lower than the minus CHF 20m in 2022 – an sheer insurmountable challenge.

Sure, they had increased their FCFF by CHF 31m from negative CHF 19m in 2022 to positive CHF 12m in 2023. Promising - especially since most of it came from the increase of revenues and better inventory management.

But the growth in revenues was still not enough to avoid a CHF 10m net loss.

Furthermore, there is a CHF 67m syndicated loan outstanding – at the operational company level - which got prolonged until Oct 2025.

Though improving top and bottom line numbers, the debt amount is staggering compared to the meagre profits.

Hochdorf will eventually be able to refinance at okay rates – IF the operations continue to improve.

But time is running against the company, with ever-increasing interest payments building up.

However, I could not see why Hochdorf should not be rescued by either its shareholders, consumer or competitors.

Since it produces high-quality baby food and milk-concentrate for the Swiss chocolate industry – although decreasing its efforts in the latter one. Baby food is squarely its decided strategic focus point.

I purchased the shares around CHF 16 a pop in late 2023.

Then over the following months the share price dropped, until it hit an all-time low at CHF 1.25 a week ago after the management (as well as the auditor) voiced their doubts that the company was able to pay back its debt by its own efforts.

(Between us, this could have been understood even a year earlier by any rational investor, looking more closely at the company. I see that now.)

At this point, the market cap of the company was around CHF 3m.

At the beginning of this week, all of a sudden, Newlat, an Italian food company, declared an 11% ownership in Hochdorf along with the intention that it will restructure and turn around the company. It purchased the shares of another shareholder (Bermont).

The shares ticked up to around CHF 5 just yesterday and then on Thursday briefly hitting the CHF 16 mark before ending at CHF 12.

One could say that now my investment is not so much in the red any more.

Sure.

But imagine sitting through the whole thing on the side lines, without acting.

Especially, when you valued the company somewhere between CHF 22m and 220m (liquidation: 22m; analysts: 50m; EV: 74m; DCF: 129m; book: 158m; reproduction: 220m).

Compare that with the CHF 3m just a week ago, and you have a 7-bagger at the least.

“Heads I win, tails I don’t lose much” at its finest.

But remember, even 3m can go to zero. Thanks for the reminder Peter Lynch.

Unfortunately, I was paralysed by the huge drop in the share price and therefore did not buy in when it was at its absolute low.

I know, this is hindsight bias. Still, makes a great case study how I personally can approach similar situations in the future.

But let’s look at what I could have done differently.

What can be learned from emotional, irrational investing

For starters, I could have re-analysed the company more deeply and intensely last week. I could have reached out to people more familiar with the company and what it goes through than myself. To get more data points to refine my investment thesis.

I could have applied lean investing once more, by just adding another small position to my portfolio.

Frankly, I should have had a clear plan for what I would do in any possible scenario.

There is still a lot for me to unpack from this.

So why did I invest in the company in the first place?

I wanted to test my “Lean Investing” concept. Build up a tiny position after a quick analysis but before doing deep research.

My proof of concept worked, since I found a company that gave me an opportunity to make a nice return. However, the execution wasn’t really great on my part.

For what it is worth, I attempted to do deep value investing. The company was clearly in jeopardy, the numbers showed that. The liquidation value was still acceptable when I bought it.

At least I learned a ton during the process, and that’s something I would have probably not done if I profited from the crazy price action.

I feel better now, after writing this – at the danger of looking like a complete fool.

I don’t care, really. Sharing this with you might help you recognize situations where you are not rationally thinking about investing.

And at the end of the day, it was my money that I put on the line. Even for the (book) loss of CHF 390, what I got out of it, was well worth it.

As the legendary investor Howard Marks would say:

Experience is what you got when you didn't get what you wanted.

Happy investing.

If you’ve enjoyed this article, don’t forget to subscribe here for weekly actionable stoic investing insights, tools and productivity tips delivered straight to your inbox. And if you think this would be helpful to anyone you know, please share this newsletter and connect with me on X and LinkedIn for daily investing inspiration. |