The Best Stoic Quotes for Novice Investors That Help You To Apply Value Investing Principles

Read all issues on my website

Read time: 3.5 minutes

Key Takeaways

- 80% of your investing success comes from emotional management

- Investment quality, long-term thinking and deep research will prevail

- Cultivate indifference toward emotions around money matter

The following Stoic quotes will help you to better understand the principles of Value Investing and help you approach investment decisions less emotionally.

Those quotes can be your companion to taking more rational and level-headed investment choices. Through their timeless wisdom we can cultivate emotional indifference around money decisions and potentially ensure higher long-term investment returns.

I know from personal experience that more than 80% of success in long-term investing is driven by how well we manage our emotions.

But most investors don't pay attention to emotional management.

This persists because:

- It's not something that is taught in business school or in professional certification courses.

- It takes time to work on ourselves to learn how to manage our emotions and build awareness of them. This takes conscious effort.

- It's not something that is thought of as value adding by most parts of the investing community. Especially in professional environments where there is an emphasis on quarterly results.

However, you reading this is evidence that you acknowledge the importance of emotional management.

The following quotes will assist you on your quest of mastering your emotions and acquiring a Stoic mindset in investing:

"It is the quality rather than the quantity that matters." — Seneca

To paraphrase Seneca here: It's not the amount of portfolio positions you have, it's the quality of those positions that matters. You only have to find a handful of great investments to become wealthy. Take Warren Buffett as an example. Most of his investments weren't successful big time. But the few that were made him a fortune. As value investors we subscribe to hunting for great companies, even if that means ending up with a highly concentrated portfolio. |

"No great thing is created suddenly, any more than a bunch of grapes or a fig. If you tell me that you desire a fig, I answer that there must be time. Let it first blossom, then bear fruit, then ripen." — Epictetus

Fast wealth is a dangerous concept and a mind trap.

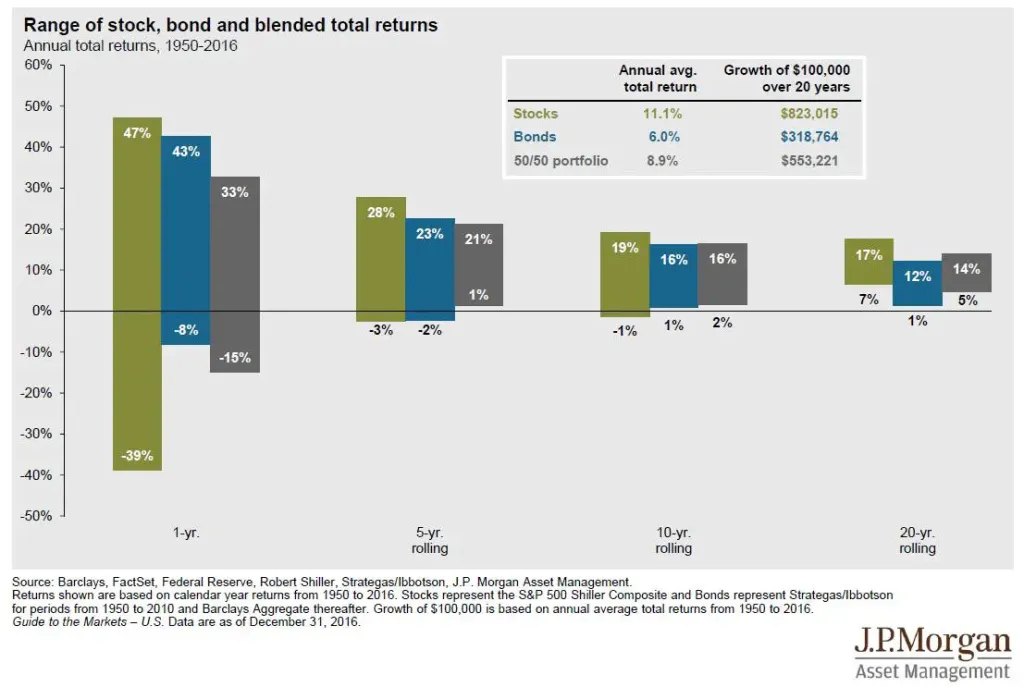

Investing long-term is the only sensible approach to wealth creation in the stock market. It can be difficult to appreciate this fact. If you are not convinced, look at the data:

The volatility is much higher in the short-term. Contrary to this, you are almost guaranteed to end up with a positive return over the long-term. As the data shows, this is true for indices, but it also applies to a portfolio of well-chosen, deeply researched individual stocks.

Great things take time.

"We should not, like sheep, follow the herd of creatures in front of us, making our way where others go, not where we ought to go." — Seneca

What Seneca describes here is called herd mentality.

This happens frequently in the markets when investors - or shall I better say, speculators - are experiencing fear of missing out (FOMO). Instead of objectively valuing a company they succumb to blindly engage in the market since others are enjoying rising returns. We must at all times refrain from such thinking.

It just leads to making bad decisions and possibly lots of pain. Do your own research and think for yourself.

"Everything we hear is an opinion, not a fact. Everything we see is a perspective, not the truth." — Marcus Aurelius

We will never have perfect information about an investment situation.

Therefore, it's even more important to interpret the data we have access to as rationally as possible. And regardless of the outcome, that we acknowledge that the decision we took at the time was the best we could (our best guess). The only thing left to do when a position is going against us, is to act with decisiveness, even if that means booking a loss, or hold it out.

Taking decisive action in the face of loss is where I struggle the most myself.

"Look back over the past, with its changing empires that rose and fell, and you can foresee the future too." — Marcus Aurelius

There is a constant war raging in the business world. It's the fight against the inevitable decay of a company's competitive advantage.

We can take Kodaq or the former Swiss airline Swissair as examples.

When a company's strength and its biggest asset becomes its own worst peril. Swissair was once nicknamed "The Flying Bank". A reference in part to Swiss banking but also to its seemingly never-ending capabilities of generating cash.

After 1996, when Philippe Bruggisser took over as CEO of Swissair, the company's strategy shifted.

Swissair started acquiring other airlines operating at deficient margins and facing huge operational challenges. After hybris came the fall. In case of Swissair it was the grounding of its fleet after 9/11. And it never recovered from that, declaring bankruptcy in 2002.

A success story of 71 years ended abruptly. That's not only a lesson in mismanagement but also in how quickly an overwhelmingly successful company can be wiped out.

And that this will happen again, again and again in the future.

"Learn to be indifferent to what makes no difference." — Marcus Aurelius

|

|

"Experience is what you got when you didn’t get what you wanted."

Which quote resonated with you the most?

Note it down, share it with a friend and try to apply it to your own investing. I'll do the same.

Happy Investing.

If you’ve enjoyed this article, don’t forget to subscribe here for weekly actionable stoic investing insights, tools and productivity tips delivered straight to your inbox.

And if you think this would be helpful to anyone you know, please share this newsletter and connect with me on X and LinkedIn for daily investing inspiration.