1 Metric That Helps Fund- And ETF-Investors Uncover Hidden Costs And Saves You Lots Of Money: Introducing The TER

Read time: 2.5 minutes

Key Takeaways

- Past fund performance alone should not be the sole criteria for your fund selection. You should also consider costs

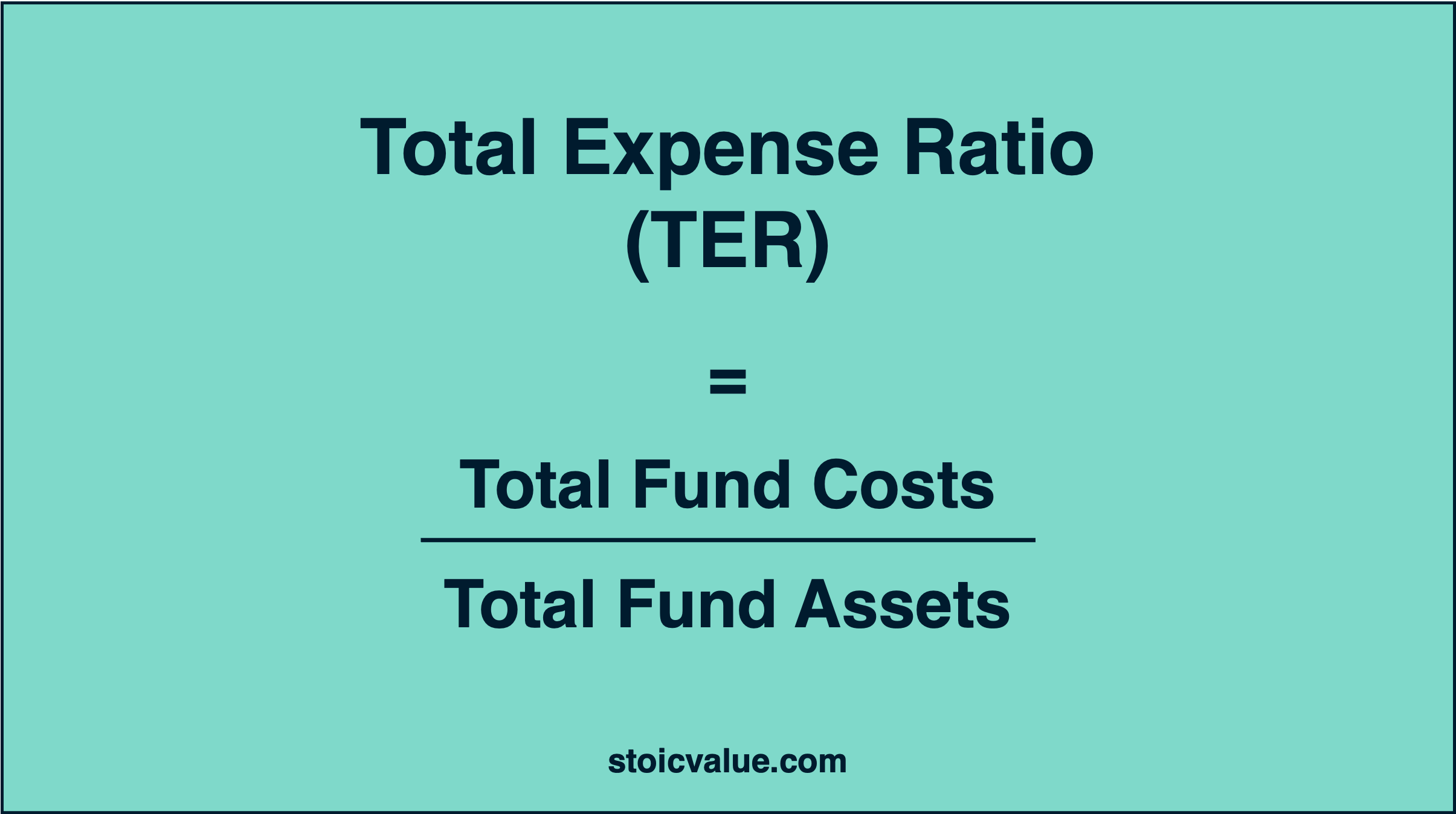

- The Total Expense Ratio (TER) is calculated as the total fund cost divided by the total fund assets.

- The lower the TER, the more you keep. A great TER is somewhere around 0,50%.

When investing in Funds and ETFs it's important to leverage one central metric to keeping costs low: the total expense ratio (TER).

The TER tells you all about the fees for fund management you will incur. Knowing the real cost that you pay for money management is key because over a long period of time, like 20 years, every tenth of a percentage point will add up to a large sum. This applies for profits as well as cost.

Today we look at what the TER is, where you find it and what a great TER looks like.

However, many investors might overlook this because:

They fixate on past fund performance.

This single-focussed perspective is dangerous.

Here are two more reasons why you should not only look at past performance:

Past fund performance is important, of course. But just remember that past performance is no indicator for future performance.

We chronically underestimate the power of compounding - especially of cost incurred.

But from today on you will choose funds and ETF differently.

Let's dive in:

What the total expense ratio is and how it is calculated

The TER is calculated as follows:

This means that it includes all the cost for the operation of the fund. Such as fund employee salaries, accounting fees and brokerage fees.

However, there might be some additional cost that are not covered by the TER. Usually, costs like the issuance or entry fee (the fee you might have to pay to initially invest in a fund) are not included in the TER.

Given the calculation above, it should also become clear why actively managed funds (a human being making the investment decisions) versus passively managed funds (mechanically implementing a pre-defined investment strategy) are more expensive.

You will see that reflected directly in a higher TER for actively managed funds and ETFs.

Where you can find the TER

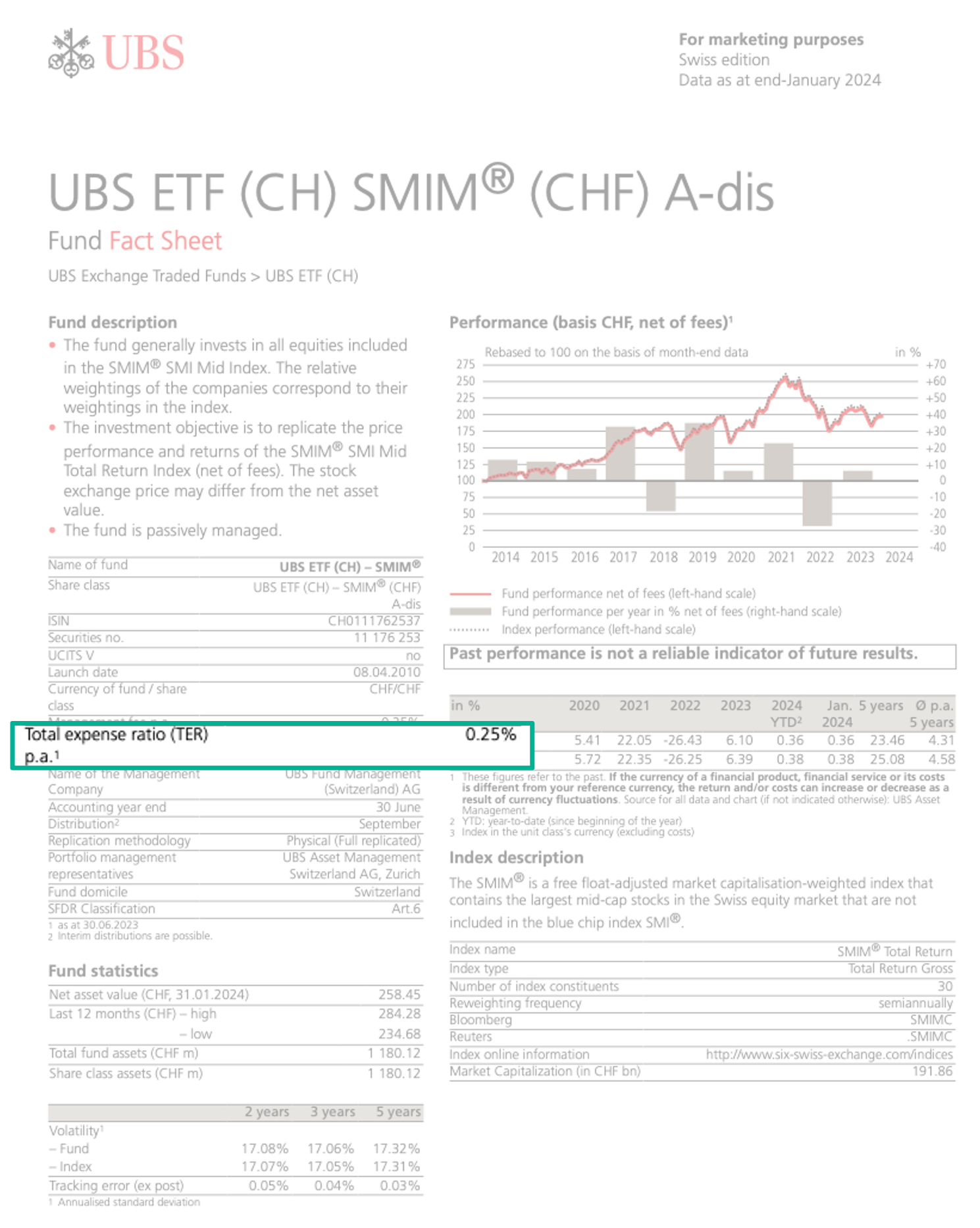

The Total Expense Ratio can be found either in the prospectus or the marketing materials of any fund or ETF.

As an example, we can find the TER for an ETF managed by UBS on their fund fact sheet:

Make sure you consult the fact sheet or ask your investment advisor about the total expense ratio before you make any investment. This will save you lots of money down the road. In fact, it could save you up to 60% in fees over 20 years.

How?

By knowing this:

What a great TER looks like

A great TER lies somewhere around 0,50% or lower. But this is often only achieved by passively managed funds such as the one in the example above.

The lower, obviously, the better.

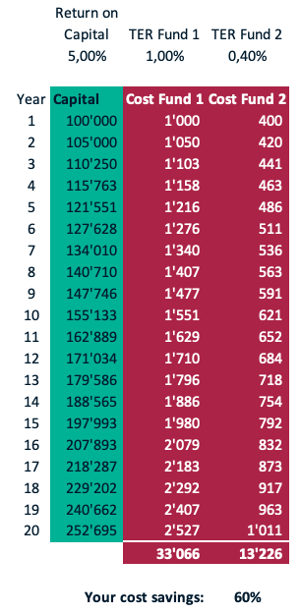

And when calculated over a long period of time, let's say 20 years, the difference is really adding up:

A general rule of thumb is that the TER should not be higher than 1% for private investors. As we have seen, even this can be 2-4 times higher compared to a passively managed ETF.

With this you are now ready to find the cheapest fund and in the process you will save lots of money.

Happy investing.

Disclaimer: This article is for information and educational purposes only. None o f the information contained in this article should be construed in any way as financial, investment or other professional advice.