This strategy gets you from saving to investing without spending hours on research: Dollar Cost Averaging

Read time: 4 minutes

Key Takeaways

- The Strategy: Invest an equal amount at regular time intervals.

- The biggest benefit: Minimum of emotional management needed - by design.

- Participate in the stock market and build wealth long-term - month after month.

- Get ahead of 95% of people investing in the stock market.

Today's issue is explaining to you what Dollar Cost Averaging, or DCA for short, is, what benefits it brings you, why it works, what potential pitfalls there are and what you can do today to get started.

But first, let's look why people might not follow this strategy:

It takes patience.

We all want to get rich quick. That's a fact. If you could make a guaranteed 100% return in one day, why on earth wouldn't you do it?

But we all know that this is not how the world works. There are always risks involved. There is no free lunch.

Especially, beginners lack the knowledge and experience needed to capitalize on complex strategies that leverage a huge amount of risk to make a quick profit.

But investing is simple at its core. Contrary to what the industry often says, you can do it yourself successfully. You just need to let consistency and time work in your favour.

Here's how, step by step:

The Strategy: Dollar Cost Averaging

|

|

Why it works: Long-term upwards trend

This strategy will work long-term because of this:

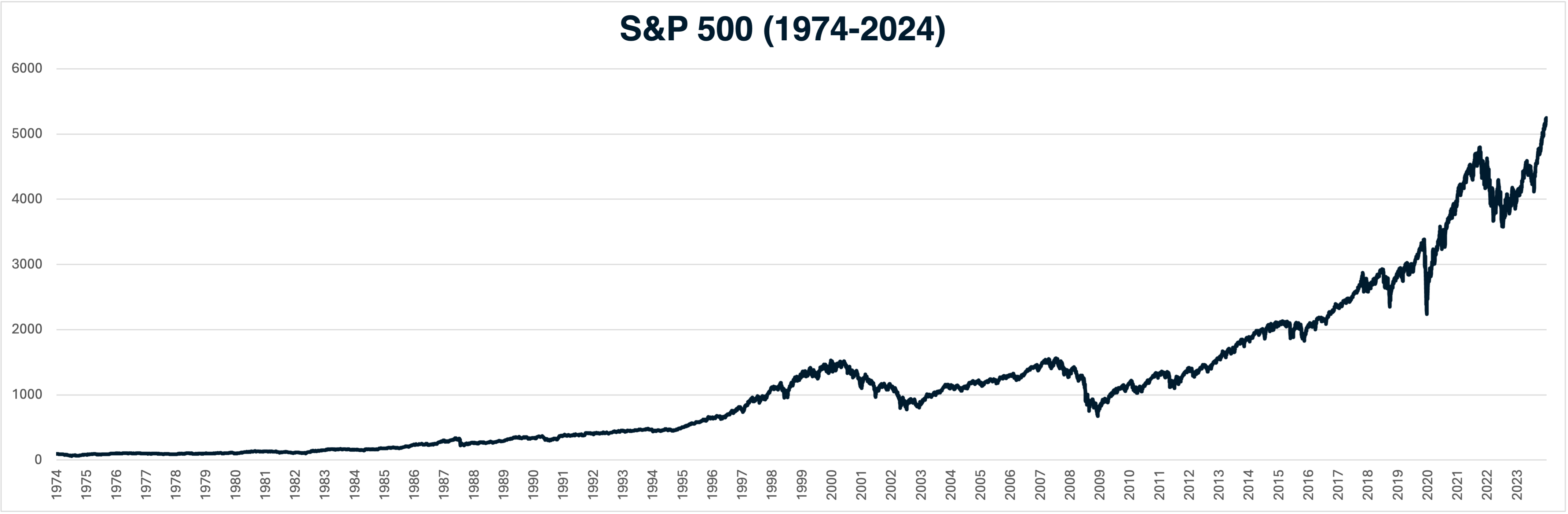

In the last 50 years, as shown above, the main stock index (the S&P 500) of the biggest economy globally (the USA), has grown.

Of course, there have been times when it contracted. But overall, especially over a long period of time, it has shown an upward trend.

There is no guarantee that this will continue into the future, at least not how it did in the past.

But at the end of the day, what guarantee do you have that the world will not end tomorrow?

To be an investor, is to be an optimist about the future, while being a realist in the present.

The stock market is designed to transfer money from the Active to the Patient.

- Warren Buffett

The Benefits: Participate in the markets with ease

Because of its simplicity and mechanical approach, DCA has important benefits compared to picking single stocks yourself:

|

But the most important benefit is surely:

- You don't have to be fighting your emotions.

Don't underestimate this aspect. Investing should not become something you worry about, but something that brings you joy and freedom eventually.

Therefore, a mechanical strategy such as Dollar Cost Averaging is particularly useful in volatile markets. Because those are the times when FOMO (fear of missing out) and other emotionally driven mental distortions can really mess with your psyche.

The investor's chief problem—and even his worst enemy—is likely to be himself.

- Benjamin Graham

Additionally, DCA can help you achieve the following goals:

Your primary and long-term goal, why you start to invest, will differ. It could be to obtain financial freedom. Or to have some funds on the side for when you want to buy a house. But Dollar Cost Averaging can help you get there without experiencing excruciating psychological pain. |

The Stumbling Block: Impatience

The only thing within your own circle of control that could make the implementation of this strategy falter:

Good old impatience.

My advice: Don't rush it.

Continue to live your life. You don't have to put all your savings or income surplus into your investment portfolio. Use some of it for living. Because what good does it do you if you are unhappy but end up with 5 million?

Sure, there are worse things. But don't over-optimize your finances by neglecting other desires.

Just keep to your strict monthly investment plan. Invest the same amount every month, without fail.

With that, you are well on your way to achieve your investing goal overtime.

Next Steps: How you can implement this starting today

Follow these 5 steps to get started today:

- Decide on an amount that you can invest every month without fail.

- Open a trading/portfolio account at your trusted financial provider.

- Set up an automated payment from your income account to your portfolio account to transfer your monthly amount automatically.

- Find the most prominent index ETF for your country.

- Buy shares of that ETF - every month - regardless the price.

- Do this for the next [fill in a number] years.

And that's how you implement a simple, yet powerful investment strategy that takes care of emotional management by design and lets you participate in the growth of the stock market long-term.

Happy investing!